It is 2010 when Roy Lübbers and his father knock on the door of the then newly founded Flinc, receiving what is known as "very early stage funding" from the brand-new fund in order to start producing their innovative product. Father and son Lübbers developed a universal cap to protect the threads of drilling pipelines: not an everyday product for a challenging market. And thus not the easiest route either, it soon became apparent.

High confidence in innovative product

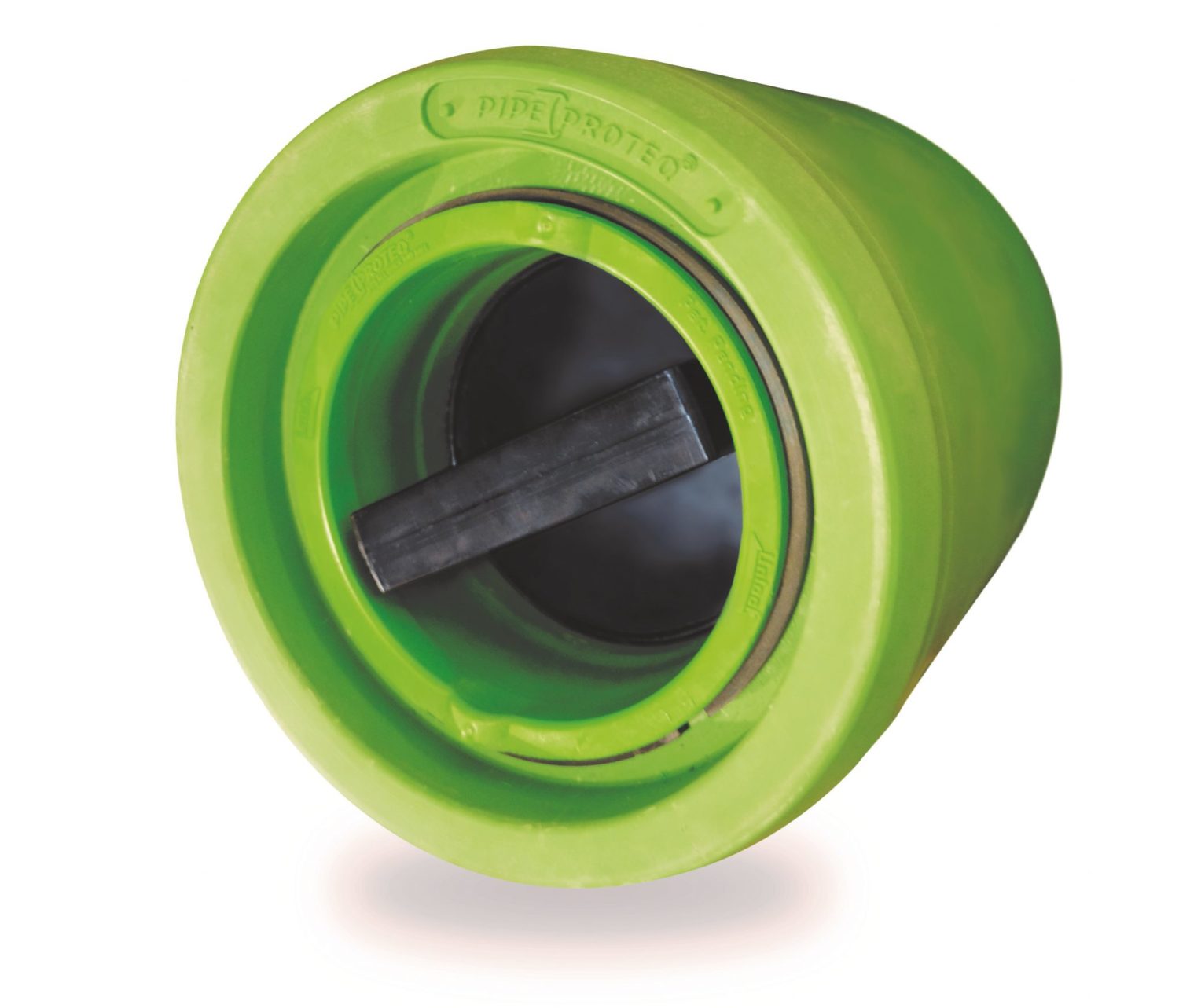

'What kept us going was that everyone always had faith in our idea and its implementation,' Roy Lübbers says. 'My father came up with this cap after he retired; he worked in the oil and gas industry for many years and was always annoyed at how cumbersome it was to install caps to protect the fragile threads on pipes. It is essential that these threads be protected and that is what caps have traditionally been used for, only the installation and removal of these caps is labor intensive, not optimally safe and there are some 250 types of threads on the market that all require a different cap in the old method. Our product is almost universal in use, easier to use and saves time.

Golden egg?

Sounds like a golden egg, but reality is proving more unruly. The gas and oil market is conservative. They see the value of the product, yet they do not yet dare to actually implement the innovation. And then the oil price plummets. Lübbers: "The interest remained, but no one from the industry dared to invest at that time. And of course we had obligations to our financiers. We were able to keep the drip on which we were lying on the drip through private investments. Fortunately, we got in touch with an outside financier, from the industry, who was able to help us. We then began consultations with the NOM.

Space as a lifeline

Chantal Leijendekker, investment manager NOM: 'When we invest, we naturally do so with the idea that the investment will be returned. In this case, a new shareholder was able to step in if we gave that space. This new shareholder came from NOM's network and had a lot of experience in the sector. Then our consideration is: what is best for the company? We recognized the importance of this new shareholder for the future of the company and therefore chose to exit in this case.' Lübbers: 'This development allowed us to look forward again. When there are financial concerns, that is difficult to achieve. We then focused on another market segment. Us drilling rigs. Our caps there provide a direct time savings of 4 hours per drilling. That's thousands of euros, because hours on a rig are expensive.'

WHAT KEPT US GOING WAS THAT EVERYONE ALWAYS HAD FAITH IN OUR IDEA AND ITS IMPLEMENTATION

Persistence pays off

Pipe Proteq is regaining bacon on the bones with this change in direction and is always exploring new opportunities and markets for their product. These appear to be there: in early October they signed an agreement in the US where their hoods are now being rented out by a collaboration partner. 'We made more sales in the first half of 2018 than all the years before. I can really say that things are going very well. And that we are far from finished. The perseverance wins. We persevered, even when things were very difficult and that is now paying off'.

*NOM looks back

How are the companies in which NOM participated in the past actually doing? In this column, together with entrepreneurs, we look back at developments between then and now.